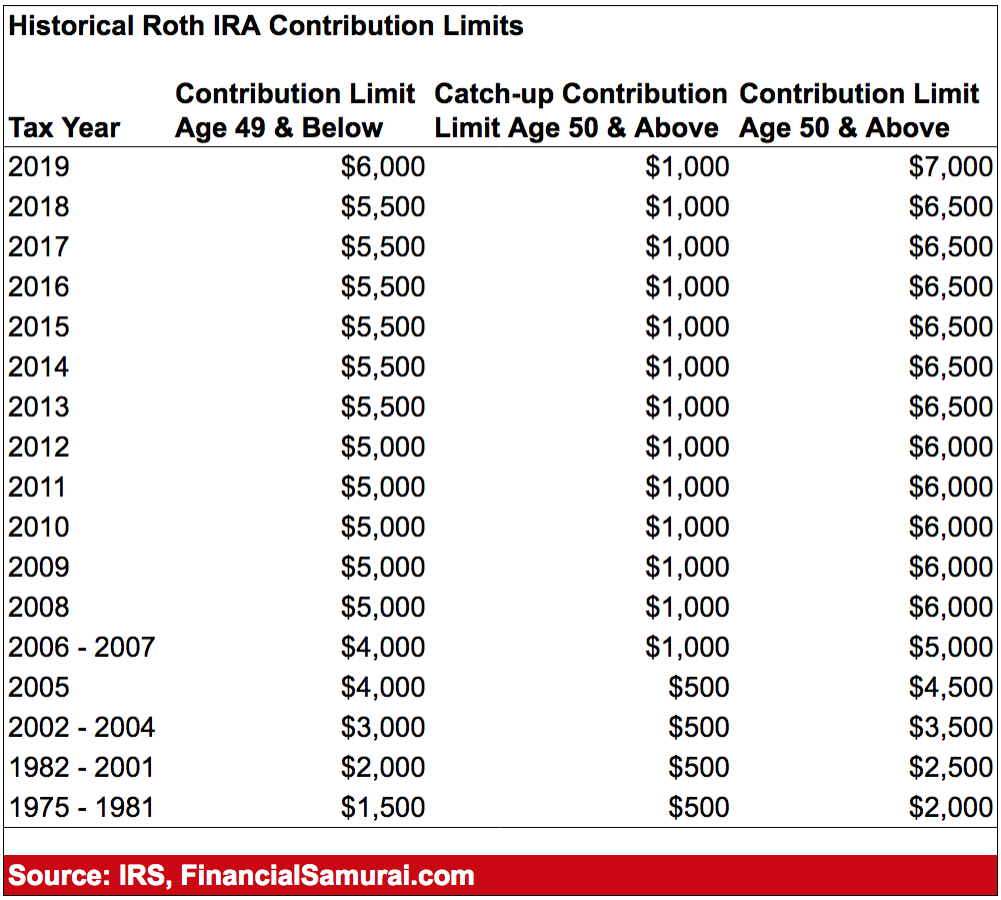

Roth Ira Contribution Eligibility 2024. If you have roth iras,. The roth ira contribution limit for 2024 is $7,000.

This increased by $500 from 2023. The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you’re.

Use this free roth ira calculator to estimate your roth ira balance at retirement and calculate how much you are eligible to contribute to a roth ira account in 2024.

Why I Never Contributed To A Roth IRA But Why You Probably Should, Browse investopedia’s expert written library to learn about rules, eligibility, and more. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024.

The IRS announced its Roth IRA limits for 2022 Personal, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024. Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your.

What Is The Ira Contribution Limit For 2022 2022 JWG, The result is your reduced contribution limit. Whether or not you can make the maximum roth ira contribution (for 2024 $7,000 annually, or $8,000 if you're age 50 or older) depends on your tax filing status and your.

Tax Rules 2024 Retha Martguerita, If you are 50 and. The roth ira contribution limit for 2024 is $7,000, with an.

Roth IRA Contribution rules Ultimate guide for 2023 Nexym, If you have a roth 401(k) plan and a roth ira, your total annual contribution across all accounts in 2023 cannot exceed $29,000 ($30,000 in 2024), or $37,500. December 2024 gives you an extra 11 months for your investments to grow, as an example.

2024 Roth Ira Limits Trude Hortense, Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. If you have a roth 401(k) plan and a roth ira, your total annual contribution across all accounts in 2023 cannot exceed $29,000 ($30,000 in 2024), or $37,500.

Roth IRA 2024 Contribution Limit IRS Rules, Limits, and, But there are income limits that restrict who can contribute. 2024 roth ira contribution limits and income limits.

IRA Contribution Eligibility Flow Chart — Ascensus, If you have roth iras,. Those are the caps even if.

+1500px.jpg?format=1500w)

2024 Traditional and Roth IRA and Contribution Limits, If you are 50 and. This increased by $500 from 2023.

Is A Backdoor Roth IRA A Good Move For Higher Earners?, If you are 50 and. Browse investopedia’s expert written library to learn about rules, eligibility, and more.

Gerard Way Interview 2024. Gerard way on dc comics' young animal imprint, his musical detour […]

Richmond Top Doctors 2024. Ophthalmology published december 30, 2023 by virginia business dr. Sentara internal […]